Retirement “The Golden Age” or The stressful age?

Is your retirement income shielded from income taxes and market volatility?

How have your wealth-building strategies factored in the loss of capital or income in retirement due to those taxes & volatility?

Most people today only focus on now. The problem is they are not looking down the road to when they would like to use the money they have grown over the years. The whole point of building wealth is to be able to use and enjoy it with your spouse and family. Having a lot less stress in Retirement should be the goal.

The hard issues currently are that the government’s debt has never been higher, social security is estimated to be out of money around 2035 and now you have just had trillions of dollars of COVID relief sent out to the United States population…

Who’s going to pay for all of this???

Unfortunately, you know the answer…

It has always been important to plan for taxes and not just while building wealth but for when you want to use that wealth to live, travel, and spoil your grandchildren. Now it should be at the forefront of all your financial planning decisions or be prepared for a lower lifestyle than you had hoped as your partner, The IRS, is going need/want more of what you have so carefully saved and invested over your working years…yes they would like to re-negotiate their cut…

Yes, it sounds painful and it will be, But it’s likely not too late…

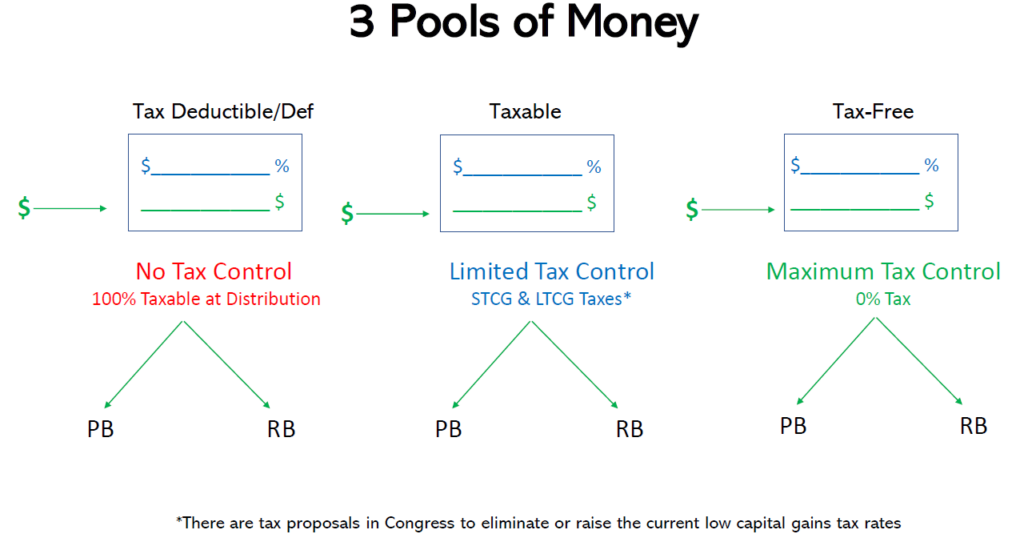

Introducing the 3 Pools of Money Analysis

How are your funds allocated; not in the way you might think with stocks, bonds, and real estate but how are they allocated among the various types of tax treatment that will face you when you go to use and enjoy that money?

This is an allocation you must review now and keep monitoring as you work hard to be able to enjoy Financial Freedom sooner than later. The benefit of analyzing this now is so you can have a better idea of where you are going to end up, but before you get there consider some changes now that could be beneficial.

I always quote Stephen Covey who wrote the highly acclaimed book “The 7 Habits of Highly Effective People “. In his book, he said, “Begin with the End in Mind”. It makes total sense of course. In financial planning, however, most don’t factor that in enough. They look at the here and now.

3 Pools of Money Modeling

The other great risk you face in retirement is the sequence of returns. There have been many studies showing that the order that investment returns occur while simultaneously taking distributions in retirement can greatly affect how long your money will last.

Hopefully, this will help you pay more attention to your finances in a meaningful way so that your lives can be better in retirement.

If you would like a no-obligation consultation or conversation or a free copy of my book “The Entrepreneurs Guide to achieving Financial Freedom”, reach out and we will be happy to send it to you. You can also visit my website at www.hdci.biz and I can be reached at 516 677-6208.

Jay E. Hochheiser, CFP®, CEPA

President & CEO

Hochheiser, Deutsch & Company, Inc.

Jay E. Hochheiser is a Registered Representative and Financial Advisor of Park Avenue Securities LLC (PAS), 355 Lexington Avenue, 9FL, New York, NY 10017, 212-541-8800. Securities products and advisory services are offered through PAS, member FINRA, SIPC. Financial Representative of The Guardian Life Insurance Company of America (Guardian) New York, NY. PAS is a wholly-owned subsidiary of Guardian. Hochheiser, Deutsch, and Company, Inc. is not an affiliate or subsidiary of PAS or Guardian. Guardian, its subsidiaries, agents, and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation. 2020-109323, Ext 0922.